Tariff

Your Digital Assistant

for

Cross Border Trade

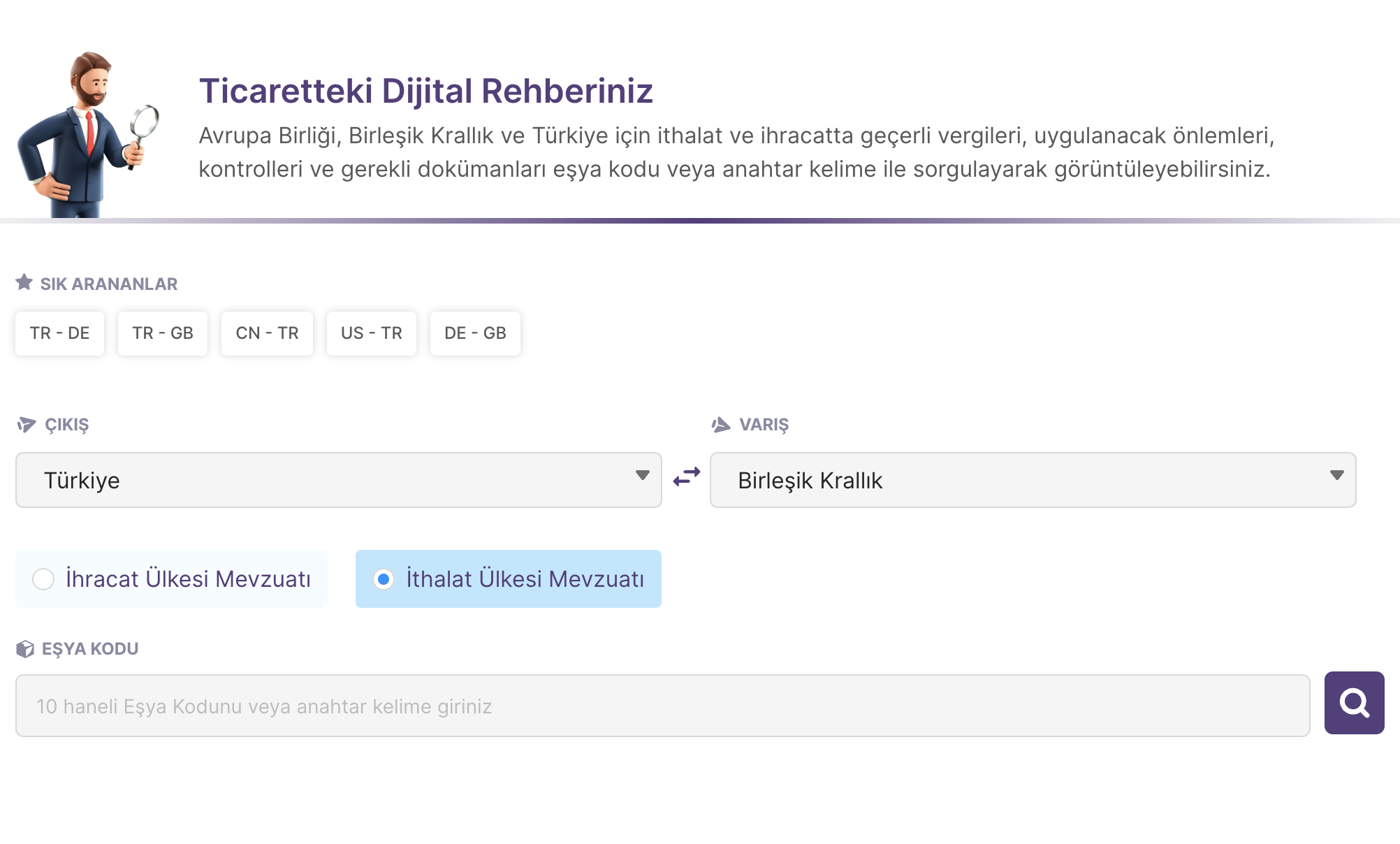

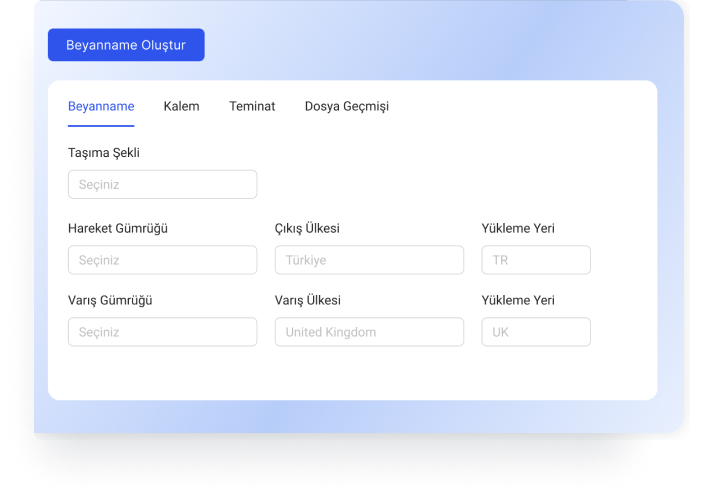

Tariff is your go-to digital solution for seamless, transparent cross-border trade. Operating currently within the European Union, United Kingdom, Switzerland, and Türkiye. The platform presents customs regulations, duties, and control measures. With just a few clicks, Tariff enables users to access critical information tailored to their trade routes, ensuring a smoother, more efficient, and compliant import or export process.

Product Modules

Query Service

Tariff allows users to select a trade route and either export or import country measures, input the commodity code, and search to quickly find relevant customs regulations data

Tax Calculation

Tariff offers a tax calculation module for your Turkish import inquiries, letting you estimate customs duties and other import taxes with a few clicks. Tax calculation module will be available for other countries in scope soon.

Find My Commodity Code

Simply define your good with keywords and search it. Tariff helps you identify the appropriate commodity codes for your goods based on keywords you enter. Benefit from always up-to-date nomenclature for European Union, United Kingdom, Switzerland, and Türkiye.

Key Benefits

With lots of unique blocks, you can easily build a page without coding.

Real-Time Updates

Receive real-time updates on customs regutions from official sources as they happen, keeping you one step ahead in the fast-paced world of international trade.

Multi-Country Support

Access customs regulation data for European Union, United Kingdom, Switzerland, and Türkiye, with ongoing expansion efforts to include more countries. Establishing TARIFF as a truly international resource for trade facilitation.

Up to Date Tariff Nomenclatures

Stay ahead with always up-to-date tariff nomenclatures. Every change tracked by TARIFF to serve its users.